If there’s one thing which I’ve learnt, and perhaps the only thing, is that these things which are said by investment experts, where the Nifty will be 12 months down the line, where the stock price will be four quarters or 8 quarters, is complete and absolute bunkum. You know, there is no way in the world you can predict these things.…

The one things which I regret, in my career as a business or television commentator, is that we’ve played our part in leading people to a very short-termist, predictive kind of a mindset, for equity markets. That is not the asset class. I think we’ve played our part in telling people that listen to the chartists, because they’ll be able to tell you where the market will be tomorrow or next week. Listen to analysts who can predict where markets will be in three quarters time. And I think that’s a mistake. If I could do it differently, in hindsight, I would do it differently.

Because that is not how smart investors behave. They never tell you that my investment in this stock is predicated on my Nifty target of 9500 in 2016. If they did that, they would never make money. But amateur investors make the mistake of doing that; which is why they don’t end up making a lot of money, unfortunately.

The full video is here:

Some of this is true. I have often spoken of my distaste for predictions, even of my own. Because predictions are about a binary thing – either you get it right or you don’t. But profit is a different thing – you can make lots of little profits (you’re right many times!) and one large loss (you’re wrong once!) – which means you have a great record as a predictor but a horrible record as an investor.

But I don’t share his distaste for the short term. We have seen an incredible bull run in the last fifteen years, and a big bear market with a V shaped recovery. We would be ignorant if we didn’t know that the highs of 2007 – when the Sensex was at 21,000 – is still way higher in rupee terms than the 28,000 levels today, because if you factor in 8% inflation, that value was way higher today. We have, in effect, seen inflation lifting stocks, which is why ooh, the long term looks so good.

It’s not so great when you don’t have that inflation supporting you. When you can’t just buy any stock and it will go up. When you have that level of inflation supporting stocks, you can be the “oh I will buy for the long term” and forget about your purchases after you buy. It’s a different story now, when even stories that made great sense in the longer term are no longer so.

The focus on the short term is also about our lack of safety nets. People want to see money fast, because they don’t trust that they will see it later. But there’s a deeper, richer story. It’s the power of the shorter term trader that makes it useful for a longer term investor to work the markets. If there were only long term investors you wouldn’t have a market. If that is true, then it’s as important to cultivate the short term trader as much as it is to help long term investors.

Having said that, the approach of asking for five stocks every hour of a technical analyst will result in, for the most part, junk. The technical analysts know it too, and they also know that you could look at any chart and come up with a bullish or bearish stance in 15 seconds, and it will sound intelligent. The channels love it, and the viewers love it, and the long term investors don’t even bother to watch TV because they’d rather read balance sheets. For the channel, it would be sinful to ignore the short term investor, but it is true, in my opinion, that they could have done a lot more to educate people on the insane risks of mad-bullish or panic-bearish behaviour.

Or, that the short term trader should focus on probabilities, not outcomes. That there’s a point about diversifying short term bets too. That a risk management framework – from sizing positions to setting up stop losses – is essential. That you need a trading log – which most channels do not maintain of their own analysts. (Btw, having been on TV, I know my prediction record isn’t good either. But all our trades, at Capital Mind, have a log, and our results have been good.) Or that you simply need to take it on the chin and accept that either a) you don’t know or b) you’re just wrong – every once in a while.

We have a new breed of long term investors on twitter who will shout out their stocks saying “5% up today” every time a stock moves. And when it falls, they are a long term investor. This is because people are thirsty for the winners, even if it didn’t matter that the investment was just 1% of the person’s portfolio and if it doubled, it would mean a 1% return for him. We are built for focused joys, not lasting happiness. We love the adrenalin of a 5% move, but a 0.5% move on 20 continuous days doesn’t make us salivate. That is why we love reality shows, soap operas, and gambling – because something’s happening or being made to happen all the time.

TV is, really, a reflection of ourselves. Udayan walked away from it all and can probably say all that he wants with a straight face, but the reality is that he loved the short term guy when he was out there, and they loved him back. He’s now like the rich old bald man who tells the struggling young career guy that money shouldn’t be the only thing in life. Right, after you made enough of it.

You dont get an award for dying, & that’s pretty much all that's guaranteed in the long term.

Oh & btw, my prediction for the Nifty for 2016 is – it will move between various numbers.

The Folly of Short Term Predictions by Udayan

Reason for Sensex crashing to 13 month low

The BSE Sensex and Nifty are trading near 13

months low and have declined 17% from the 2015 High which we saw on 04

March 2015. In Just 6 months Stock market have wiped out the gains made

in past 13 months.Let me put the reason from both Technical and Fundamental Perceptive Sensex

corrected by 500 points Nifty almost 200 Points making today as Black

Friday.

Fundamental

- Concerns over Fed rate hike

Equity Market likes liquidity, Friday Strong US jobs data and

Unemployment rate coming sub 6% fueled expectations that the US Federal

Reserve may raise interest rates sooner than previously thought.

Hike Rate means sucking liquidity out of system and this will

flight to safe assets in Bonds and stronger currency like USD and money

getting sucked out of Emerging market. India Markets have received

$11Billion in 2015 till date and up 8% till date so profit booking can

be done by FII’s.

- Expensive valuations of Stock Market

Sensex is trading at more than 20 times FY15 and 17 to 18 times

FY16 earnings, ALSO PE (Price to Earning Ratio) as discussed was

touching 24 before correction has started and still trading around 21 so

valuation are still not reasonable.

- No Pick up in Earnings growth

It will take at least two quarters for the easy monetary policy

benefits to trickle down and pick-up in earnings growth is likely to be

the next big trigger for markets. The third quarter results were quite

disappointing worst quarter result in almost 5 years.

Dollar gaining strength

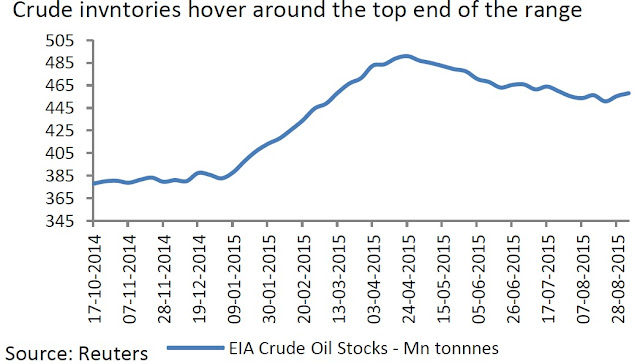

The dollar index is gaining strength against basket of currencies including rupee. Yesterday Mario Darghi has also said to increase QE which will further weaken Euro and Dollar will rise is due course.- Slowdown caused by China and Yuan Devaluation

- Rupee at lowest since September 2013

Technical

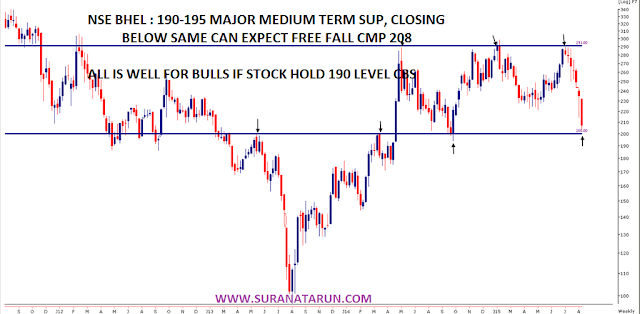

- Trading below 200 DMA/8k Level : Nifty/ Sensex are trading well below its 200 DMA, putting pressure on market, as many FII’s have 200 DMA benchmark for buying or selling.Break of sacrosanct level of 8k and closing below it for 2 week is sign of weakness.

- Gann Date Effect- As discussed in Weekly Analysis Gann/Appoint and Gunner plays an important role in finding impulsive move, all studies were pointing towards a big move.

- NF opening volume in first 15 mins was 25 Lakh highest seen in past 2 years suggesting serious long liquidation by smart money.

TATA MOTOR DVR > < TATA STEEL

THOSE WHO CAN'T AFFORD 300 BUCKS FOR TATA MOTORS CAN INVEST IN

TATA MOTOR DVR AROUND 200-210 LEVELS FOR LONG TERM

VOTING RIGHT DIFFERENCE + 5% HIGHER DIVIDEND TRADING @ 34% DISCOUNT

TATA MOTOR DVR AROUND 200-210 LEVELS FOR LONG TERM

VOTING RIGHT DIFFERENCE + 5% HIGHER DIVIDEND TRADING @ 34% DISCOUNT

What is a DVR share?

DVR stands for Differential Voting Right. Companies issue DVR shares to prevent any hostile takeover and dilution of voting rights. This also helps strategic investors who are looking at a big investment in a company, but with fewer voting rights. A Tata Motor DVR has 10 per cent voting right as compared to an ordinary Tata Motor share.

Why should retail investors invest in DVRs?

DVRs are suitable for retail investors who are not concerned with voting rights as they don't intend to affect the decision making of the management. The same company's shares are available at a lesser price for the same fundamentals. Besides, Tata Motors DVR fetches 5 per cent higher dividends as compared to ordinary shares of Tata Motors.

What are the disadvantages?

DVR shares are usually thinly traded. Also, during bearish phase, the discount over Tata Motors shares could widen and this could be a dampening factor.

HSBC: A Look at History Shows World Markets Are Close to the Bottom

Since 1988, the MSCI All Country World total return index has

suffered a drop of more than

10 percent on 16 occasions, averaging a 20 percent decline over a span of 18 weeks.,

By comparison, this retreat has lasted for 14 weeks, during which time the index has given back 19 percent. Though timing the market is a tricky task indeed, Laidler points out that investors who manage to buy the trough can look forward to an average 12-month return of more than 20 percent:

10 percent on 16 occasions, averaging a 20 percent decline over a span of 18 weeks.,

By comparison, this retreat has lasted for 14 weeks, during which time the index has given back 19 percent. Though timing the market is a tricky task indeed, Laidler points out that investors who manage to buy the trough can look forward to an average 12-month return of more than 20 percent:

Other factors such as elevated valuations and low earnings growth

amplified the

pressure on global equities, effectively adding "fuel to the fire."

The S&P 500 has tumbled by at least 2 percent for three consecutive sessions as of Monday,

only the third time this has occurred in more than 50 years.

pressure on global equities, effectively adding "fuel to the fire."

The S&P 500 has tumbled by at least 2 percent for three consecutive sessions as of Monday,

only the third time this has occurred in more than 50 years.

Do Not Panic. Its all going to settle down ^_^

All red over the heatmap. Top loosers from Nifty 50 pack are VEDANTA, GAIL, TATA STEEL, CAIRN crashed more than 13%. And Nearly 31 stocks out of 50 crashed more than 5%.

Sector Heatmap

All sector ends in red. Top loosers are from Airlines, Gems & Jewellery,

Hospitality, Tyres, Real Estate, Paper & Shipping sectors

Subscribe to:

Comments (Atom)